International Trade

Product Definition

The specifications of gum Arabic have not been modified, and remain the same as those elaborated during the 31st Codex Committee for Food Additives, held at the Hague, in Holland, from the 19th-23rd March 1999. These specifications consolidated previous definitions, by re-affirming that “gum Arabic is the dried exudate from the trunks and branches of Acacia Senegal or Acacia Seyal in the family Leguminosae”. The exudate from A. Seyal is a friable gum, which has become more important in the last ten years in terms of supply and demand in the international market. Gum Arabic is essentially marketed by countries in the gum belt hereafter referred to as producer countries, where the Acacia species, and in particular, A. Senegal and A. Seyal species grow in arid Africa, south of the Sahara.

Global Export Production

The source of information on import/export data on the global gum Arabic market is data from Comtrade DBS, except in the case of Sudan, which publishes this information annually. Table , shows the quantities in metric tons of raw gum Arabic sold globally, by African and Asian producing countries. The quantities of raw gum Arabic exported shown in Table don’t correspond to actual gum Arabic production. This is because in Table , the quantity of gum Arabic consumed locally is not included, as well as the quantity not exported, which is occasionally accumulated as stock. Therefore, the quantities recorded are not a reliable measure of the world’s production of gum Arabic.

Table : Export of Raw Gum Arabic (in Tonnes) – 1991-2002

Year | SUDAN | CHAD | NIGERIA | AFRICA. others | SUBTOTAL-AFRICA | ASIA | TOTAL |

1991 | 25,909 | 2,228 | 6,706 | 1,463 | 36,306 | 809 | 37,115 |

1992 | 17,061 | 2,450 | 8,358 | 3,073 | 30,942 | 726 | 31,668 |

1993 | 13,475 | 3,701 | 7,042 | 2,243 | 26,461 | 756 | 27,217 |

1994 | 23,341 | 4,558 | 9,822 | 3,751 | 41,472 | 684 | 42,156 |

1995 | 18,143 | 7,001 | 9,914 | 2,821 | 37,879 | 814 | 38,693 |

1996 | 17,671 | 7,365 | 12,164 | 3,349 | 40,549 | 435 | 40,984 |

1997 | 17,342 | 8,527 | 10,199 | 5,301 | 41,369 | 696 | 42,065 |

1998 | 25,053 | 12,584 | 8,166 | 2,296 | 48,099 | 384 | 48,483 |

1999 | 19,305 | 11,312 | 8,598 | 3,399 | 42,614 | 912 | 43,526 |

2000 | 21,916 | 11,682 | 8,239 | 4,009 | 45,846 | 2,251 | 48,097 |

2001 | 26,105 | 12,881 | 8,747 | 2,137 | 49,870 | 471 | 50,341 |

2002 | 34,162 | 10,664 | 6,556 | 2,724 | 54,106 | 258 | 54,364 |

Source: International Trade Centre, Geneva

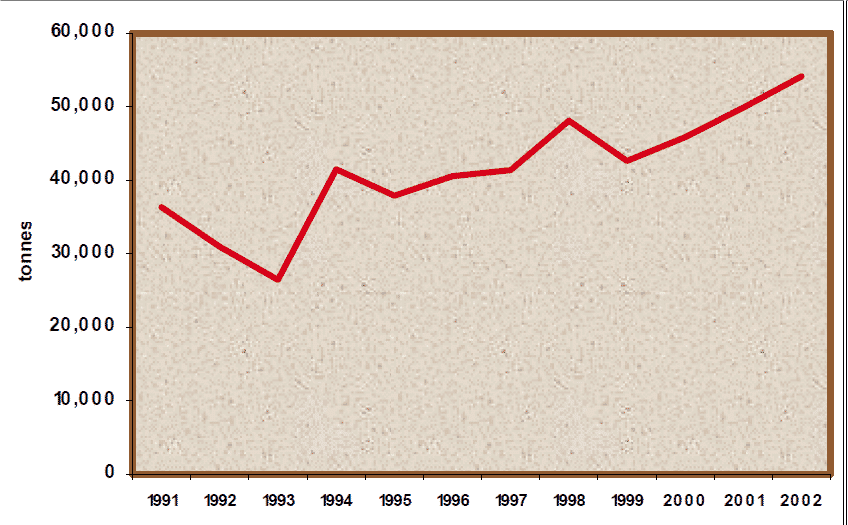

In the last 12 years, the raw gum Arabic exported from Africa increased from 36,000 tonnes to more than 50,000 tonnes, an increase of 28% as shown in Figure.

Figure : Export of raw gum Arabic from Africa (1991-2002)

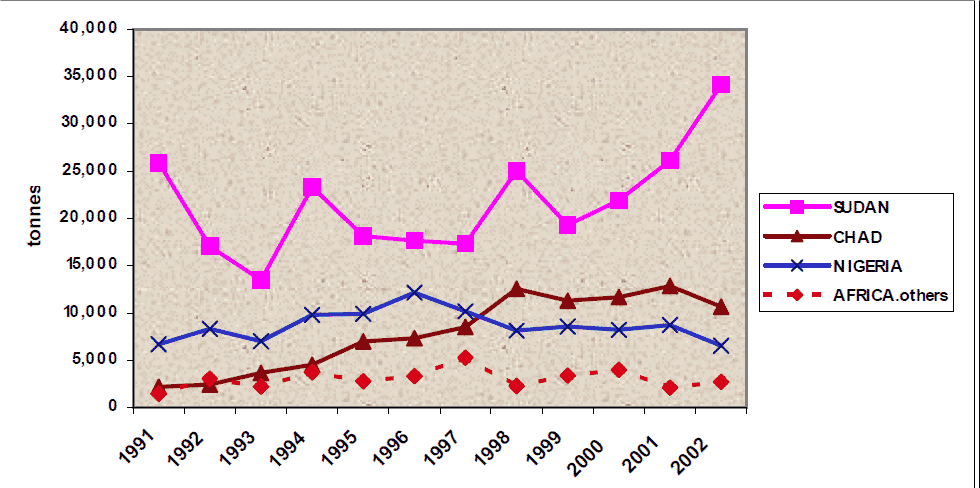

The three main producing countries are Sudan, Chad and Nigeria, which cover 95% of the global gum Arabic export market. As shown in Figure 2, Sudan maintained over 50% of the world market while Nigeria had 20%. In ten years (1991-2002), the production of Chad increased from 10% of the global market to 25% becoming the second largest producer in the world. The remaining 5% is divided among 10 African countries. The trend in 2001-2002 shows a slight reduction in the amounts of gum Arabic exported by Chad and Nigeria and an increase in the Sudanese exports. This is clearly shown in Table , comparing the export of Gum Arabic in 2001 and 2002.

Figure : Export of Gum Arabic by country (1991-2002)

Main Exporting Countries

Very few gum-producing countries (5 or 6 but not the major ones) avail their customs data. The estimates of their exports are therefore done in retrospect (“mirror” analysis) by a detailed analysis of the imports to countries that re-export or consume gum Arabic.

It is common knowledge that there is a flow of gum Arabic on the borders of gum producing countries, but in the absence of any records from the concerned customs authorities, it is not possible to take these amounts into consideration here, for the purposes of calculating the real contributions of each gum producing country to the export Market.

For several years now however, a reduction of the flow has been observed, notably from the Lake Chad area where most of the gum Arabic is increasingly exported directly by each country and especially so by Chad itself, which is the 2nd largest producer of Gum Arabic in the world and most of whose gum Arabic comes through FOB N’djamena. This has greatly reduced the flow of gum Arabic, which used to leave through neighboring countries, therefore adopting the customs identity of those countries.

Available data for the year 2002 shows, accordingly, in tons, and in a descending order from the highest to the lowest, the following gum producing or exporting countries (Table ):

Table : Further Analysis of Principal Producing Countries

Country | % | |

Main Gum Producing Countries

| Sudan | 63 |

Chad | 20 | |

Nigeria | 12 | |

Minor Gum Producing Countries

| Cameroon | 2.2 |

Ethiopia | 1.6 | |

Tanzania | 0.6 | |

Eritrea | 0.5 | |

Others | Ten Other African Countries | 0.1 |

Gum re-exporting Countries | Central African Republic | 99 tons, marginal |

Three countries contributed 95% of the produce offered in the market; eight countries follow with more than 4.5% and about 10 others all contributed marginally by less than 0.5%, and quantities to the tune of about 20 tons (about 1 container per year). It will be noted here that minor gum producing countries are interested in this market, which, in both Sudan and Chad Represents one of their five principle sources of exports (In Chad it ranks third).

The Central African Republic has availed data from the customs authorities showing that most of her exports are re-exported without however declaring their countries of origin, which are without doubt neighboring gum-producing countries.

Imports

Table shows the volume of imports in metric tons. It also gives the position of each country or groups of countries as a percentage of the total calculated traded volume. An increased trend in the importation of Gum Arabic on a global scale is also evident from Table.

1996 and 1997 were transition years in the import market for gum Arabic; these two years saw the crash of the hard gum Arabic market, and according to sources from the review Tropical Markets, the gums lost half of their market value between March 1996 and March 1998. The imports of 1997, and more so, those of 1998, confirm this decline in prices of gum Arabic, reaching average prices of around US$ 2000/MT for A. Senegal gum.

The prices had a downward trend reaching values of US$ 1,500 per Tonne FOB Port Sudan for A. Senegal gum and US$ 800 for A. Seyal gum CIF by late 1999. This led to a tremendous recapture of the market of food additives and the building up of stocks at these low prices.

It is also evident from Table 3 that the main imports of the gum Arabic for the year 2002, are still centered in five countries or regions of the European Union (EU 15). If direct imports from Scandinavia are considered, 2/3 of the world importations of raw gum are confined in Europe.

Table : Imports of Raw Gum Arabic (1991 –2002)

Tonnes | FRANCE | U.K. | U.S.A. | INDIA* | GERMANY | ITALY | JAPAN | OTHERS | TOTAL |

1,991 | 9,781 | 6,810 | 5,479 | 3,311 | 3,251 | 3,451 | 1,983 | 2,998 | 37,064 |

% | 26 | 18 | 15 | 9 | 9 | 9 | 5 | 8 |

|

1,992 | 9,691 | 7,402 | 2,681 | 2,668 | 4,114 | 1,095 | 1,682 | 2,570 | 31,903 |

% | 30 | 23 | 8 | 8 | 13 | 3 | 5 | 8 |

|

1,993 | 10,560 | 4,724 | 2,035 | 2,573 | 2,957 | 2,058 | 782 | 1,746 | 27,435 |

% | 38 | 17 | 7 | 9 | 11 | 8 | 3 | 6 |

|

1,994 | 12,009 | 4,653 | 6,916 | 3,763 | 4,371 | 5,201 | 1,447 | 3,362 | 41,722 |

% | 29 | 11 | 17 | 9 | 10 | 12 | 3 | 8 |

|

1,995 | 10,675 | 4,247 | 5,364 | 7,547 | 4,518 | 2,169 | 1,072 | 2,740 | 38,332 |

% | 28 | 11 | 14 | 20 | 12 | 6 | 3 | 7 |

|

1,996 | 12,450 | 4,079 | 6,454 | 8,334 | 2,528 | 1,735 | 1,220 | 3,987 | 40,787 |

% | 31 | 10 | 16 | 20 | 6 | 4 | 3 | 10 |

|

1,997 | 15,931 | 4,836 | 6,078 | 6,095 | 3,252 | 699 | 1,379 | 3,371 | 41,641 |

% | 38 | 12 | 15 | 15 | 8 | 1 | 3 | 8 |

|

1,998 | 20,075 | 5,137 | 9,028 | 5,621 | 3,058 | 644 | 1,599 | 4,081 | 49,243 |

% | 41 | 11 | 18 | 12 | 6 | 1 | 3 | 8 |

|

1,999 | 15,631 | 1,829 | 6,563 | 6,574 | 3,672 | 2,096 | 1,265 | 5,730 | 43,360 |

% | 36 | 4 | 15 | 15 | 9 | 5 | 3 | 13 |

|

2,000 | 19,202 | 3,744 | 6,835 | 5,638 | 4,405 | 1,147 | 1,717 | 5,307 | 47,995 |

% | 40 | 8 | 14 | 12 | 9 | 2 | 4 | 11 |

|

2,001 | 20,738 | 3,310 | 7,780 | 4,777 | 5,398 | 2,040 | 1,724 | 3,810 | 49,577 |

% | 42 | 7 | 16 | 10 | 11 | 3 | 3 | 8 |

|

2,002 | 22,182 | 4,807 | 7,444 | 4,710 | 4,521 | 2,365 | 1,080 | 6,891 | 54,000 |

% | 41 | 9 | 14 | 9 | 8 | 4 | 2 | 13 |

The figures for India represent only 66% of the real imports because 34% consists of mixed gums,

Sources: International Trade Centre, www.p-maps.org, in Geneva.

As shown in Figure 3, France is the world leader of importing and re-exporting countries of gum Arabic. Within a period of 10 years, France is leading with imports of more than 40% of the total global importations of raw gum, ahead of UK, which has less than 10% of the market. Germany and Italy, share around 10% of this market. The U.S.A, India and Japan share between themselves 25% of this same market.

Other countries such as emerging countries of Eastern Europe, South America and Asia are importing more and more gum Arabic. Chad is now contributing to the newly emerging countries in the consumption of gum Arabic and is at present developing commercial relationships with more than 12 developing countries, while Sudan has developed a commercial relationship with about 30 countries. Nigeria has partnered with less than 10 countries and is lagging behind, losing its share of the commercial gum market.

Figure : Imports of gum Arabic by country

Re-exportation

Apart from some known exceptions such as Central African Republique (C. A. R), which re-exports, gum from other countries, the main gum Arabic that is re-exported, is done by European countries linked historically to African countries by colonialism.

In effect, the principal merchants or industrialists linked to the re-export of gum Arabic are based in France, the United Kingdom and Germany. In the year 2002, these three countries re-exported more than 25 000 tons of gum Arabic.

As shown in Table 4, France put up for sale more than 48% of the re-exported global gum Arabic, followed by UK, Germany and USA. Other European countries limited their exports to only 5% of the global market.

Table: Re-exportation of gum Arabic expressed in US$ (2002)

Country | US $ (millions) | % Global Value |

France | 38 | 48 |

U.K. | 9.5 | 12 |

Germany | 6.0 | 8 |

USA | 5.5 | 7 |

Other European Countries | 4.0 | 5 |

Rest of the World | 16.0 | 20 |

TOTAL | 79 |

When it comes to re-exportation, Europe once again dominates the market for gum Arabic, negotiating 77% of the market, expressed in tons and around 75% of the market value in sales for the year 2002. This gross added value of the re-exported gums from the EU reached 130% of the value paid at import for the raw gum Arabic. The USA has a lower gross added value with respect to the EU of around 70%. Higher profits are realized by France, which re-exported, processed gum with an enhanced value of 150% of the imported raw gum. This gross added value also reflects the industrial cost of processing the gum Arabic by solubilization, followed by atomization. In fact, almost all the gum re-exported in 2002 was subjected to this wholesome industrial process.

The earlier industrial processes of grinding or crushing has become obsolete because they no longer correspond to the quality standards laid down by industrialized countries. These ‘dry methods of processing has become obsolete with respect to the humid processing method, which demands a more complex industrial production system (making into a solution, mixing, multiple filtrations, sterilization and finally atomization by means of an atomizer which uses the same concept as the one used in the production of powder milk). However, following in the footsteps of the Gum Arabic Company of Sudan, which was the first exporter to invest in this domain in the nineteen nineties, more and more private exporters in gum producing countries are now investing in semi-mechanized sorting equipment’s and those for crushing and grinding in order to offer cleaned gum Arabic with standard granules. These investments have resulted in an increment of about 10% of added value for producer countries and have reduced the transport of wastes (barks, wood, sand, etc ), as well as rejection of sub-standard merchandise.

The large part of the gross added value is used to finance and run these equipment’s, which all the same reduces the net added value gains of the industrial sector. It is not possible to estimate the exact net added value from the documents used to compile this article. However, the performance of the French industry (150% of gross added value) can be explained by the presence of friable gum Arabic in most of the products, which reduces by far the cost of acquiring raw material and which becomes evident in a net margin that is clearly higher. Note that when price is considered, France is the country that buys its gum Arabic at the lowest price; that is apart from India. It can therefore be concluded from the above that friable gums constitute a large part of the import of France.

Consumption by Countries

Table , presents a general view of countries that consume gum Arabic from the international market, from 1991-2002. These countries are classified roughly in descending order according to their domestic consumption in the year 2002. From this table, it is possible to calculate an average consumption of gum Arabic amounting to 51000 tons over the period 2000-2002, which is less by 30 tons than the average of exports by producer countries. This difference is accounted for by a small portion of gum Arabic re-exported under new identities such as para-pharmaceuticals and food additives.

In 2002, the first 12 countries in Table 5 represent 80% of the total consumption of gum Arabic, followed by 20 countries (outside EU 15), many which can be regarded as emerging countries and which account for 15% of the consumption and the remaining 5% of the consumption is divided amongst the remaining 25 countries. A careful look at Table 5 shows that outside the 12 big consumers; USA, France, Mexico, India, Italy, United Kingdom, Germany, Belgium, Japan, Switzerland, Denmark, Sweden, with a consumption of 1000 tons or more in 2002, there actually exists, in effect about 15 emerging countries in the import market for gum Arabic.

Table : Consumption of Gum Arabic by Country (1991-2002)

Metric Tonnes | 1991 | 1992 | 1993 | 1994 | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 |

U.S.A | 6,667 | 4,972 | 4,715 | 9,071 | 6,901 | 7,964 | 8,544 | 13,413 | 10,709 | 11,759 | 12,663 | 13,343 |

INDIA | 5,152 | 3,969 | 3,823 | 5,814 | 11,686 | 12,796 | 9,365 | 8,439 | 10,418 | 8301 | 7000 | 7,255 |

FRANCE (EU 15) | 3,083 | 2,873 | 2,785 | 3,727 | 1,785 | 3,886 | 4,943 | 7,627 | 1,884 | 5,342 | 4,761 | 5,347 |

MEXICO | 418 | 542 | 564 | 556 | 489 | 1,878 | 2,093 | 3,196 | 3,454 | 3,388 | 3,021 | 4,322 |

ITALY (EU 15) | 4,934 | 2,022 | 3,116 | 5,787 | 2,748 | 2,289 | 1,730 | 1,879 | 3,626 | 2,389 | 3,146 | 3,637 |

UNITED KINGDOM (EU 15) | 3,717 | 4,136 | 1,974 | 2,706 | 2,700 | 2,678 | 1,531 | 3,141 | 613 | 2,117 | 1,833 | 2,354 |

GERMANY (EU 15) | 1,836 | 2,507 | 1,214 | 2,215 | 1,981 | 531 | 2,095 | 1,951 | 1,753 | 2,295 | 3,720 | 2,197 |

BELGIUM (EU 15) | 826 | 619 | 627 | 1,200 | 877 | 690 | 1,229 | 147 | 154 | 636 | 865 | 1,696 |

JAPAN | 2,014 | 2,015 | 1,218 | 1,797 | 1,428 | 1,793 | 1,871 | 2,009 | 1,583 | 2,076 | 2,057 | 1,642 |

SWIZTERLAND | 887 | 794 | 1,043 | 967 | 1,023 | 864 | 729 | 1,171 | 1,224 | 1,091 | 1,050 | 1,559 |

DENMARK (EU 15) | 1,038 | 998 | 653 | 1,208 | 624 | 656 | 679 | 837 | 578 | 681 | 723 | 1,412 |

SWEDEN (EU 15) | 812 | 514 | 504 | 856 | 347 | 1,775 | 1,361 | 1,727 | 3,116 | 2,485 | 749 | 1,224 |

BRAZIL | 397 | 222 | 177 | 310 | 423 | 453 | 476 | 489 | 641 | 542 | 671 | 942 |

IRELAND (EU 15) | 756 | 409 | 215 | 409 | 868 | 1,380 | 1,199 | 659 | 435 | 730 | 789 | 941 |

CHINA |

| 106 | 48 | 207 | 401 | 162 | 263 | 748 | 726 | 640 | 923 | 872 |

KOREA | 274 | 286 | 258 | 396 | 432 | 646 | 399 | 374 | 454 | 479 | 739 | 802 |

SPAIN (EU 15) | 251 | 243 | 181 | 286 | 315 | 936 | 334 | 288 | 371 | 442 | 450 | 735 |

NETHERLANDS (EU 15) | 176 | 416 | 204 | 345 | 239 | 233 | 249 | 246 | 453 | 400 | 504 | 696 |

POLAND |

| 44 | 51 | 75 | 97 | 98 | 157 | 218 | 207 | 282 | 346 | 651 |

NORWAY | 871 | 755 | 757 | 616 | 913 | 610 | 880 | 626 | 622 | 348 | 607 | 601 |

RUSSIA |

|

|

| 18 | 23 | 18 | 17 | 31 | 133 | 227 | 335 | 467 |

FINLAND (EU 15) | 384 | 316 | 294 | 300 | 509 | 334 | 294 | 426 | 450 | 357 | 408 | 427 |

AUSTRALIA | 39 | 150 | 200 | 233 | 199 | 278 | 306 | 278 | 271 | 203 | 267 | 373 |

PHILIPPINES | 315 | 364 | 134 | 399 | 240 | 440 | 310 | 372 | 305 | 400 | 589 | 252 |

SOUTH AFRICA |

| 353 | 166 | 275 | 400 | 242 | 305 | 99 | 98 | 106 | 445 | 235 |

CANADA | 127 | 123 | 109 | 154 | 104 | 97 | 94 | 106 | 119 | 122 | 128 | 230 |

TURKEY | 53 | 76 | 104 | 75 | 61 | 81 | 76 | 110 | 86 | 128 | 128 | 222 |

PORTUGAL (EU 15) | 38 | 33 | 28 | 45 | 33 | 57 | 82 | 120 | 169 | 171 | 146 | 222 |

CHILE | 32 | 46 | 34 | 65 | 142 | 54 | 111 | 181 | 154 | 94 | 143 | 200 |

ARGENTINA |

| 146 | 294 | 247 | 296 | 238 | 374 | 308 | 307 | 320 | 342 | 172 |

ISRAEL | 80 | 50 | 80 | 50 | 70 | 90 | 100 | 120 | 125 | 150 | 107 | 132 |

HUNGARY | 16 |

| 17 | 16 | 15 | 21 | 38 | 56 | 37 | 48 | 14 | 129 |

ALGERIA |

| 109 | 94 | 58 | 57 | 95 | 160 | 67 | 220 | 190 | 135 | 118 |

VENEZEULA | 228 | 224 | 181 | 211 | 164 | 288 | 108 | 44 | 57 | 92 | 69 | 111 |

COLOMBIA | 54 | 72 | 38 | 107 | 76 | 118 | 107 | 114 | 60 | 86 | 126 | 101 |

THAILAND | 127 | 82 | 94 | 133 | 113 | 117 | 134 | 102 | 159 | 176 | 390 | 89 |

SLOVENIA |

| 62 | 62 | 84 | 69 | 60 | 50 | 58 | 55 | 62 | 69 | 83 |

ICELAND | 85 | 80 | 57 | 52 | 68 | 70 | 83 | 79 | 52 | 88 | 84 | 83 |

PAKISTAN | 355 | 504 | 250 | 479 | 637 | 425 | 225 | 305 |

|

|

| 78 |

GREECE (EU 15) | 69 | 70 | 65 | 52 | 132 | 68 | 82 | 97 | 43 | 55 | 53 | 51 |

PERU |

|

| 10 | 12 | 4 | 41 | 38 | 49 | 41 | 49 | 33 | 49 |

COSTA RICA |

|

|

| 18 | 9 | 4 | 6 | 8 | 15 | 12 | 30 | 48 |

CZECH REPUBLIQEU |

|

| 19 | 20 | 22 | 17 | 16 | 16 | 18 | 33 | 32 | 35 |

EQUADOR | 13 | 698 | 17 | 23 | 41 | 17 | 29 | 20 | 15 | 11 | 16 | 31 |

ROMANIA |

| 1 | 8 | 7 | 31 | 18 | 35 | 28 | 30 | 37 | 29 | 26 |

HONG-KONG |

| 76 | 62 | 179 | 212 | 248 | 70 | 87 | 136 | 142 | 24 | 22 |

SAUDI ARABIA | 55 | 241 | 452 | 147 | 261 | 932 | 0 | 618 | 272 | 52 | 47 | 14 |

NEW ZEALAND | 16 | 9 | 11 | 18 | 23 | 12 | 12 | 10 | 15 | 14 | 12 | 11 |

SLOVANIA |

|

|

| 12 | 10 | 8 | 8 | 6 | 9 | 77 |

| 10 |

TUNISIA | 10 | 43 | 154 | 147 | 59 | 46 | 5 | 36 | 148 | 155 |

| 7 |

CROATIA |

| 2 | 3 | 1 | 7 | 5 | 7 | 13 | 6 | 4 | 5 | 5 |

BANGLADESH | 19 | 16 | 16 |

| 5 | 2 | 1 | 46 |

|

|

| 5 |

ZIMBABWE | 9 | 12 | 13 | 7 | 22 | 4 | 14 |

|

|

|

| 1 |

MALAYSIA | 25 | 41 | 42 | 57 | 43 | 72 | 96 | 92 | 121 | 113 | 143 | -72 |

PANAMA |

|

|

|

| 12 | 14 | 13 | 8 | 16 | 31 | 5 |

|

HONDURAS |

|

| 1 | 2 | 5 | 3 | 7 | 5 | 6 | 6 | 0 |

|

PARAGUAY | 10 | 14 | 2 | 19 | 10 | 17 | 9 | 4 | 2 | 2 | 1 |

|

OTHERS | 11 | 19 | 66 | 101 | 52 | 60 | 827 | 601 | 808 | 954 | 1,216 | 1212 |

TOTAL TONNES/YEAR | 34,579 | 31,164 | 26,042 | 40,946 | 38,317 | 42,950 | 41,192 | 51,036 | 44,141 | 48,286 | 49,433 | 54,991 |

EUROPEAN UNION | 17,978 | 15,205 | 11,908 | 19,204 | 13,158 | 15,532 | 16,023 | 19,405 | 14,033 | 18,484 | 18,345 | 20,939 |

Source: International Trade Center, Geneva

The emerging trade with Latin-American countries (apart from Mexico) for example, shows a real potential of more than 1500 tons of gum Arabic mostly processed through the big trading countries mentioned here before. This potential has increased by 50% since 1998. Except for Mexico whose position as a big importer is confirmed, with more than 3500 tons (2900 tons in 1997-1999) for the period running 2000-2002, the annual average in tons over the period 2000-2002 can thus be seen as below:

♦ Brazil is overall with more than 700 tons (500 tons in the period 1997-1999)

♦ Venezuela and Colombia with above 100 tons (90 and 70 tons in 1997 and 1999 respectively).

♦ Chile consumes more than 150 tons (200 tons in 2002).

♦ Argentina maintained 300 tons (300 tons in the period 1997-1999) despite the economic crisis in the country.

Other countries, notably in Asia, China and South Korea consumed 750 tons – 800 tons each over the period 2000-2002 presenting another potential market for 1500 tons, an increase of 50% as compared to the period 1997 – 1999, for gum already processed by the big marketing countries.

Secondly, South Africa and Australia, each with an apparent consumption of 300 tons form another group whose domestic consumption of gum Arabic is beginning to expand. This has increased from 450 tons in the period 1997 – 1999 to more than 600 tons in 2000-2002, an increase of 30%.

Finally, the Eastern Europe countries have increased their purchases by between 50% and 100%, especially:

♦ Poland, which increased its purchases from 200 tons to 400 tons

♦ Slovenia, increased from 50 tons to 70 tons

♦ Hungary, increased from 40 tons to 60 tons

♦ The Czech Republic increased from 20 tons – 30 tons.

Russia increased her consumption from 60 tons in 1997-1999 to a Whooping 350 tons in 2000-2002 shattering her demand records for gum Arabic. The potential of these countries, estimated at 300 tons in 1998 increased to around 1000 tons in the year 2002.

It should be noted here that the increment of about 60% in the demand for gum Arabic between the year 1991-1993 and the year 2000-2002 is in fact, almost a third for the USA market, which registered an expansion of about 6300 tons, the other two thirds being attributed to the EU 15 which registered an increase of 4 000 tons, but above all, for listed emerging countries, with an expansion of 9500 tons. The dynamic economies of these countries can only enhance the global market for gum Arabic in the next ten years to come and take over the market from the industrial powers of the western world including Japan.

Market Prospects: Opportunities and Challenges

Although threatened by substitute products, gum Arabic still finds itself today in a more favorable position than it has ever attained during the last quarter of the century. This may be attributed to the following reasons:

♦ A simultaneous demand for both hard and friable gum Arabic.

♦ Consumer awareness vis-à-vis the quality of their diet.

♦ An abundant supply of gum Arabic from several countries.

♦ The price for the hard gum Arabic has reached a reasonable level

♦ A remarkable economic recovery by industrialized countries in the year 2004.

♦ The emergence of countries that are developing their own user industries.

All these factors auger well for the development of a global market for Gum Arabic export in the next twenty years with a possible return to the levels attained at the beginning of 1970s, before the onset of drought. In the year 2002, it can be seen that this trend is well defined and that the target of figure of 70 000 tons is no longer out of reach. The problems of depleted stock, price as well as motivation to harvest the hard Gum Arabic are the only ones that cast a shadow in the picture.

It should be remembered that the gum producing Acacia trees prevent soil erosion, enrich the soil, improves the global water resources by contributing to the fight against desertification while at the same time ensuring the livelihoods of thousands of Sahelian peasants and shepherds, which is the single most important contribution of gum Arabic.

Considering that Sudan, Chad and Nigeria cover 95% of the export of gum Arabic in international trade, a country profile has been elaborated for each country.